Zero-Touch Accounting (ZTA) is a strategic approach where Artificial Intelligence (AI) and Robotic Process Automation (RPA) eliminate human intervention in most standard financial workflows.

In a traditional accounting setup, a person must manually code transactions, match receipts, and reconcile bank statements. In a ZTA environment, the ERP or accounting software becomes the engine:

The goal is a zero-manual-input, zero-error system. The only human intervention needed is for complex exceptions or the final strategic review. This dramatically shifts the role of the business owner and the finance team from mere scorekeepers to strategic planners.

In 2026, the best accounting solution for small businesses in 2026 must integrate three core pillars to achieve true ZTA capability within an ERP environment:

Intelligent Automation is the power behind ZTA. It eliminates the time sinks of traditional bookkeeping:

A key feature of modern ERP is its modularity. The best solution acts as a central hub, natively integrating core modules like payroll and inventory management to create a seamless, end-to-end flow of financial data.

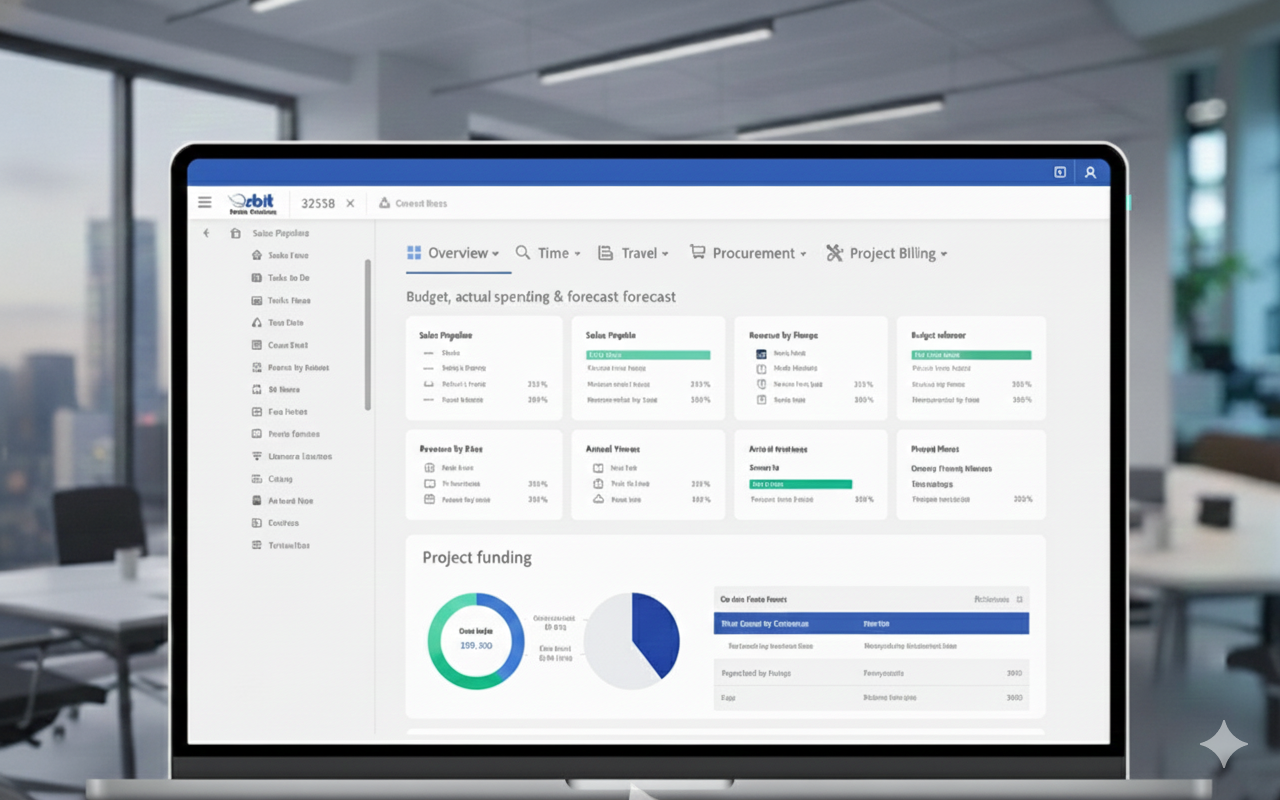

With a unified platform, when an employee is paid via the integrated Orbit Payroll module, the system automatically posts the correct salary and PAYE journal entries to the ledger. This removes manual integration headaches, ensures accurate records, and provides a single source of truth across your business operations.

Compliance in the UK is fast-moving. ZTA is essential for keeping up with regulatory demands, minimizing risk, and improving the audit trail:

Orbit Media Solutions is positioned as the best accounting solution for small businesses in 2026 because it embraces the ZTA paradigm. We were built to function as an intelligent core, enabling you to future-proof your business by:

By choosing an integrated, AI-powered platform like Orbit, you are not just acquiring software; you are future-proofing your business against increasing complexity and competition.

The future of ERP finance is autonomous. Zero-Touch Accounting is not merely a buzzword; it is a critical technology that minimizes effort, maximizes accuracy, and guarantees compliance in a real-time world.

For UK small businesses navigating the complexities of MTD and competitive pressures, embracing an AI-driven ZTA system is essential. By choosing a unified, intelligent platform like Orbit Media Solutions, you move beyond the tedious tasks of bookkeeping and unlock the strategic potential of your entire finance function.

Ready to transform your finance operations with ZTA?

Request a Free Demo of Orbit's Zero-Touch Accounting Solution

See how a premium blog can transform your presence online.

Explore hand-crafted blog layouts designed to inspire.

Copyright © 2025 Orbit